Tento’s Black Friday and Cyber Monday Guide for Online Merchants: Why, When & How to Get Capital

_Nick_Fancher_Photos_ID6069.jpg)

BFCM. An acronym that both intimidates and inspires online business owners worldwide. Black Friday and Cyber Monday represent the pinnacle of the retail calendar, with sales figures breaking records year after year. In 2023, Black Friday sales reached $9.8 billion online in the U.S. alone, with Cyber Monday hitting $12 billion (Salesforce) (FXC Intelligence). Global digital sales amounted to a whopping $298 billion, up 6% year-over-year. For online merchants, we know that preparing for this surge in demand is undeniably crucial, and securing financing can help play a pivotal role in ensuring success.

Financing Rises with the Stakes

SMB lenders see a significant increase in funding applications during the holiday season, driven by the need for additional inventory, marketing efforts, technology upgrades, staffing costs and overall cash flow management. While retailers and e-commerce businesses might focus more on inventory and marketing, manufacturers might prioritize equipment financing and production capacity increases.

“The holiday season demands a lot from businesses, Q4 is crunch time,” says Griffin Camper, Chief Business Officer and co-founder of Tento. “Additional capital can be key to leveraging your success during holiday sales. The key is knowing how much funding you need, the additional revenue you’ll make from the additional funding, and what the financing is going to cost.”

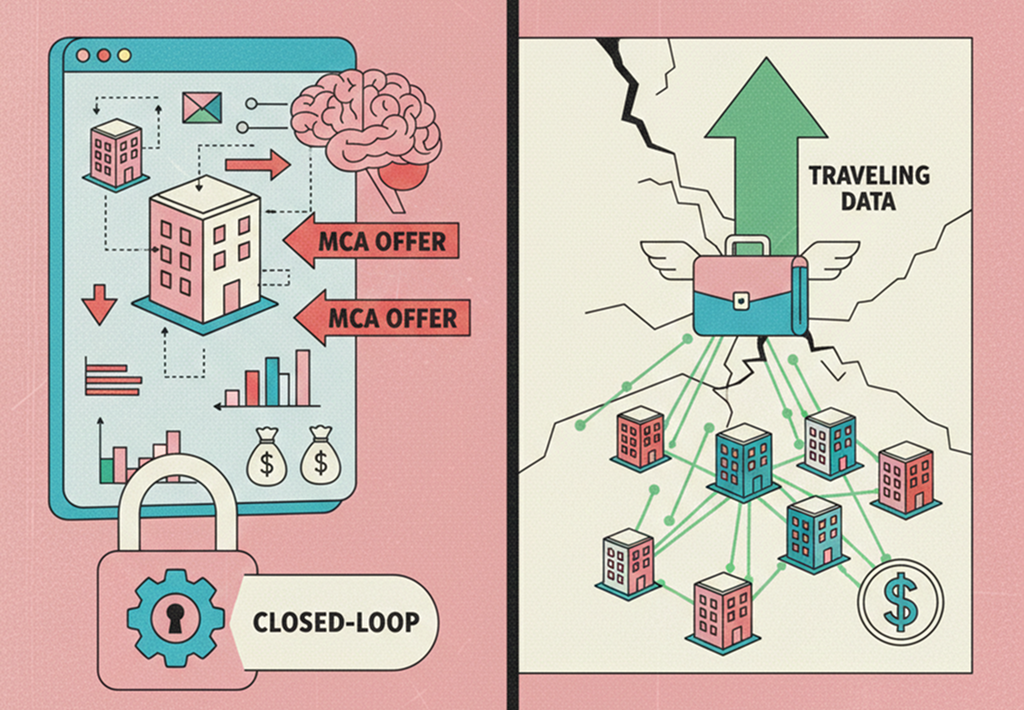

Given the massive upsides of BFCM, it’s no surprise that there’s an uptick in all things financing.” According to a report by the Small Business Administration (SBA), there is typically a 20-30% increase in loan applications and a 15-25% increase in applications for alternate financing options (Fundera), such as merchant cash advances and lines of credit, in the run up to the holiday season.

You might be asking, do I need financing in the first place? Or if I do, how much do I need? We’ll seek to help you answer what your needs are, how much financing you might want and what that will cost you.

Why Seek Financing for BFCM?

Easy access to credit ensures long-term growth.

Inventory Management

- Stock Up on Best-Sellers: Ensuring you have enough stock to meet the anticipated demand can prevent lost sales due to stockouts.

- Diversify Product Offerings: Expand your inventory to include trending items. In 2023, categories like personal care items saw significant sales growth (Fit Small Business).

Marketing and Advertising

- Small businesses often increase their marketing budgets by 30-50% during the holiday season, according to the National Retail Federation (NRF), leading to a higher demand for financing.

- Increase Visibility: With millions of shoppers browsing online, enhancing your marketing efforts through paid ads, social media campaigns, and influencer partnerships can drive traffic to your store.

- Promotional Campaigns: Attractive discounts and special deals are essential. Offering competitive deals requires upfront capital to cover the cost differences until sales revenues are realized.

Operational Costs

- Hire Additional Staff: The holiday season often necessitates hiring extra staff to handle increased customer inquiries, manage order fulfillment, and ensure smooth operations.

- Upgrade Technology: Ensuring your website can handle a surge in traffic and investing in cybersecurity measures to protect against potential threats are critical.

Cash Flow Management

- Bridge Gaps Between Sales and Payments: Financing can help manage cash flow gaps, especially if there are delays between sales and when the revenue is actually received. This is particularly important for covering immediate expenses like payroll and vendor payments.

Tento Financing Options

Working Capital

Ideal for covering immediate expenses and short-term needs, such as purchasing inventory or ramping up marketing efforts.

Equipment Loans (and Section 179)

No one knows better than you what new equipment can do to streamline operations and improve your business. If you’ve made a big equipment purchase this year or are contemplating a big purchase anytime soon, Section 179 offers a great opportunity for small and medium-sized business owners to reduce their taxes. Learn more about Section 179 right here.

Lines of Credit

Unlike a traditional loan, a line of credit offers more flexible repayment options like the ability to repay as sales revenue comes in, opening up the chance to take advantage of bulk purchasing discounts and maximize marketing spend.